tax shield formula uk

Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues. Interest Tax Shield Interest Expense Tax Rate.

Fixed Charge Coverage Ratio Fccr Formula And Excel Calculator

Formula shield tax uk.

. Tax shield formula uk. Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income. On the other hand if we take the.

Or the concept may be applicable but have. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Taxes 10 million 20 2 million.

When a company purchased a tangible asset they are able to. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with. Net Income 10 million 2 million 8 million.

What is the formula for tax shield. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. This companys tax savings is equivalent to the interest payment.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. In this video on Tax Shield we are going to learn what is tax shield. Net Income 8 million 16.

The formula for this calculation can be presented as follows. Tax Shield Amount of tax-deductible expense x Tax rate. Taxes 8 million 20 16 million.

Interest Tax Shield Example. Tax Shield formula. Companies using a method of accelerated depreciation are able to save more money on tax payments due to the.

The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Native Remedies Sweat Less Natural Homeopathic Formula For Excessive Sweating 810845017336 Ebay Native Remedies Excessive Sweating Homeopathic

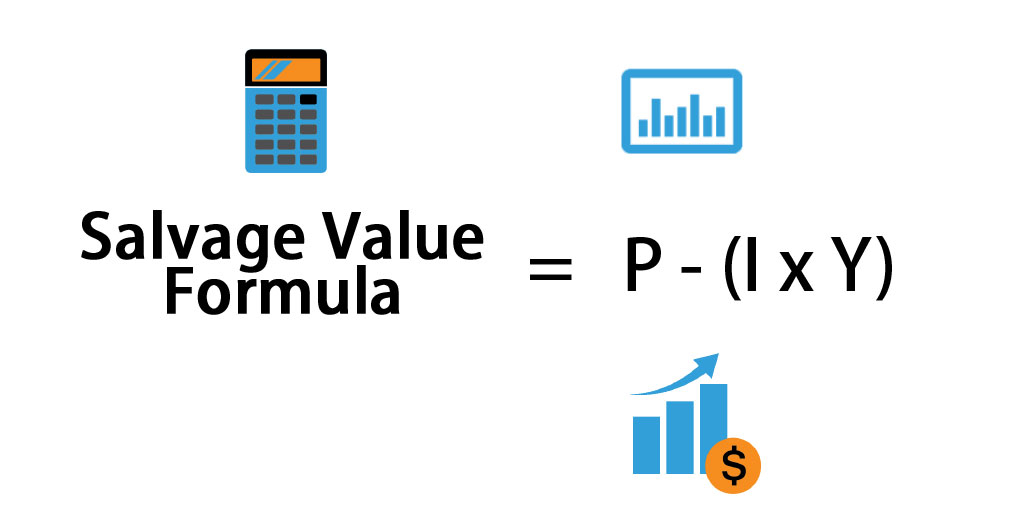

Salvage Value Formula Calculator Excel Template

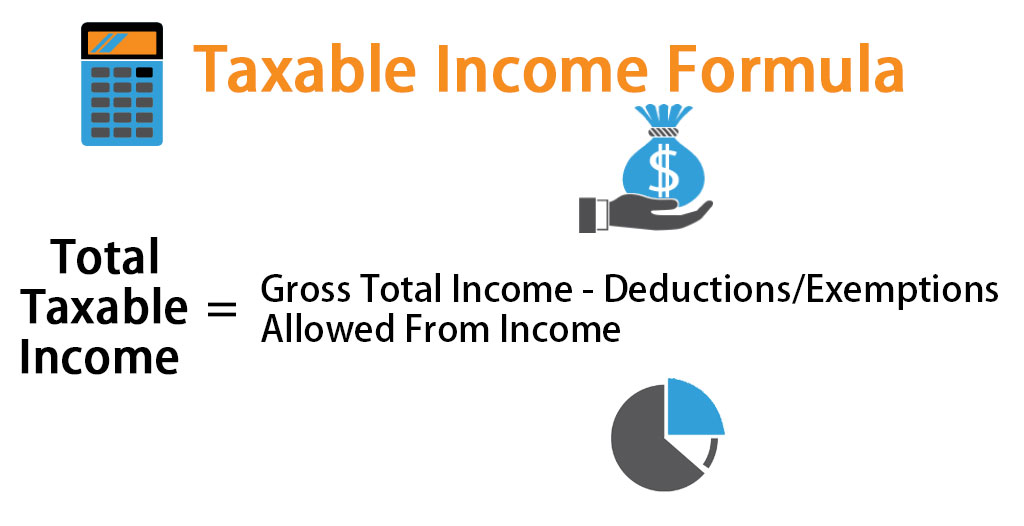

Taxable Income Formula Calculator Examples With Excel Template

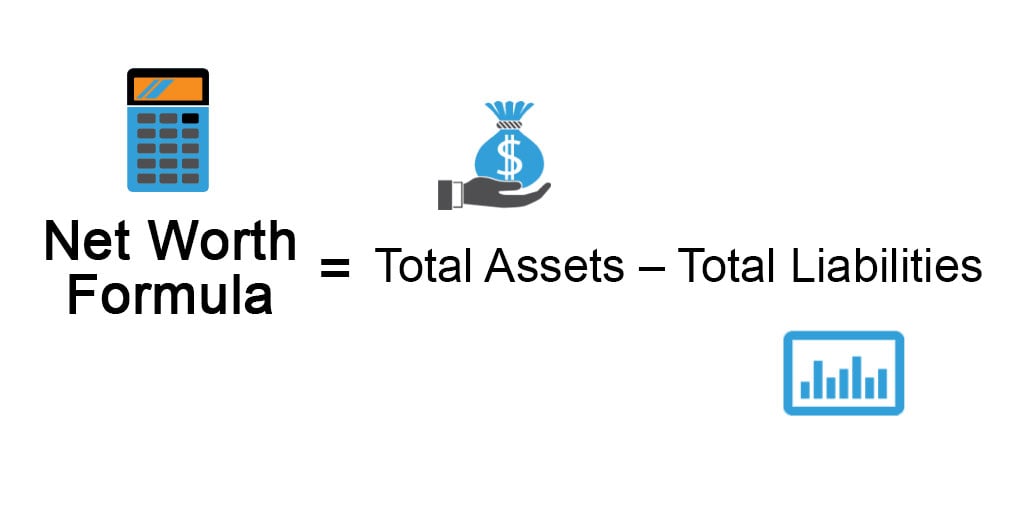

Net Worth Formula Calculator Examples With Excel Template

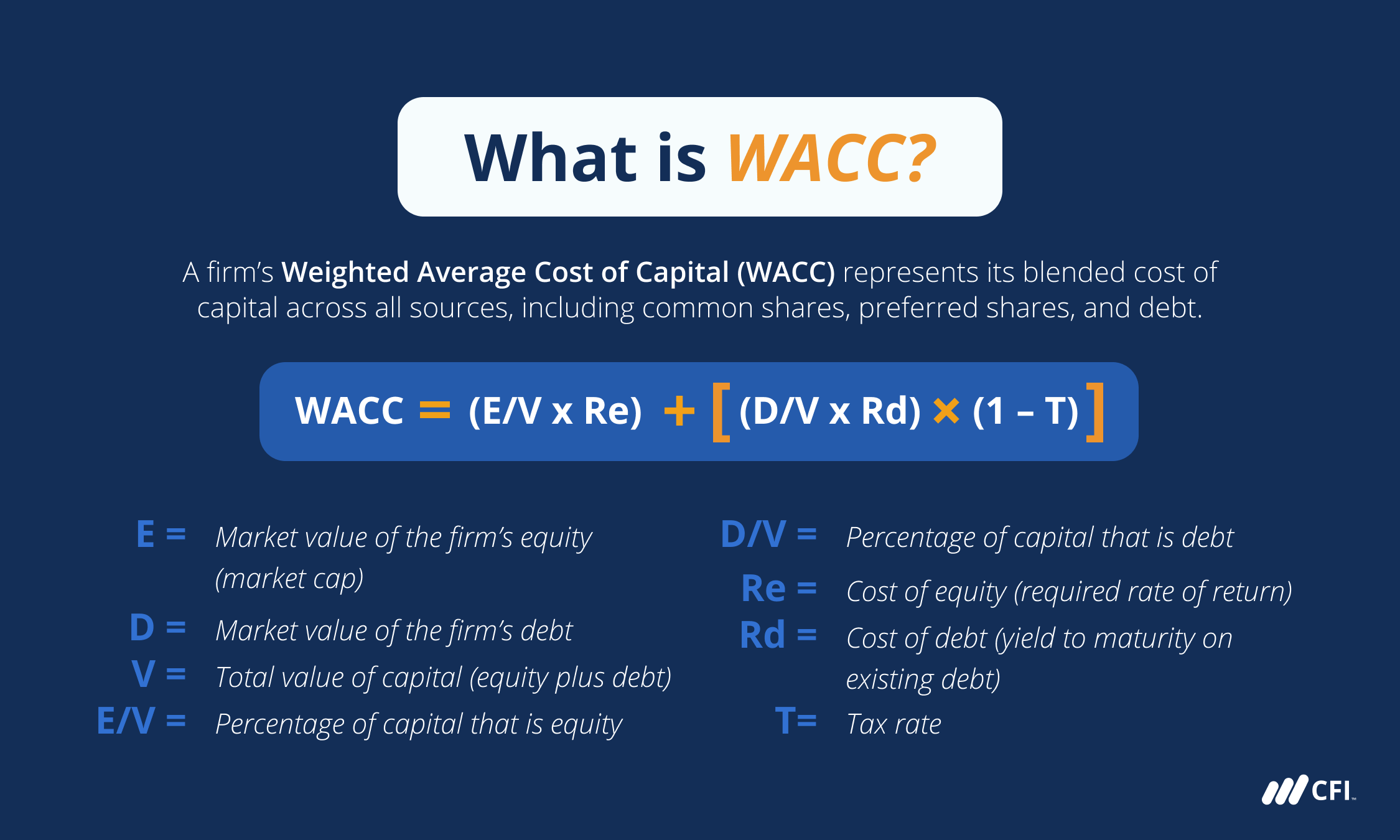

Wacc Formula Definition And Uses Guide To Cost Of Capital

Annual Percentage Rate Apr Formula And Calculator

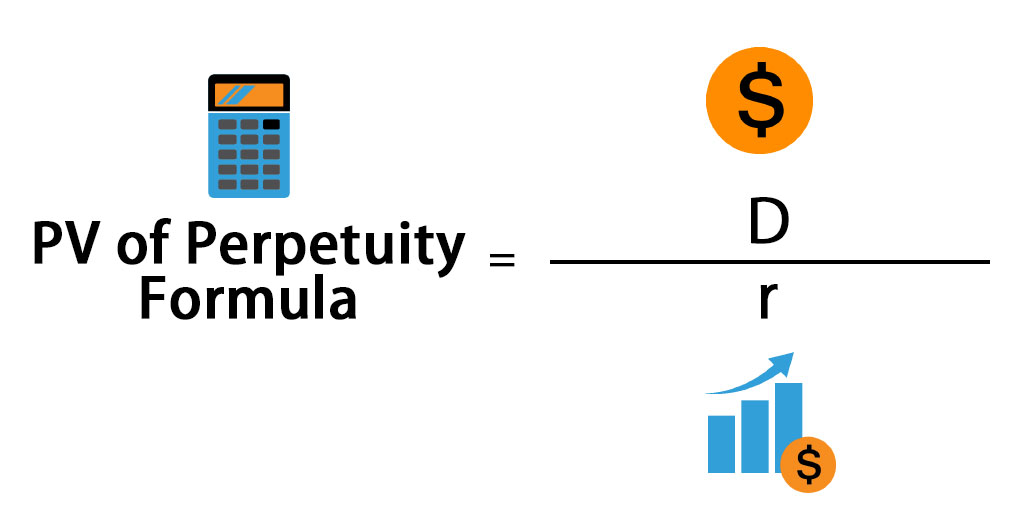

Perpetuity Formula Calculator With Excel Template

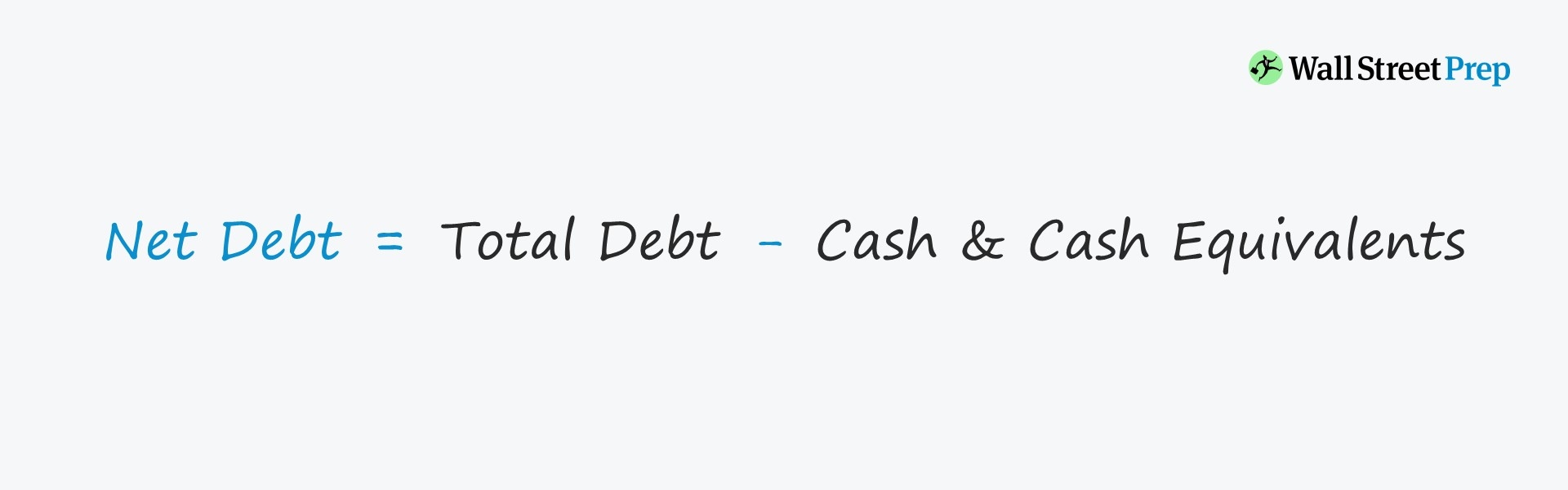

Net Debt Formula And Calculation Example Excel Template

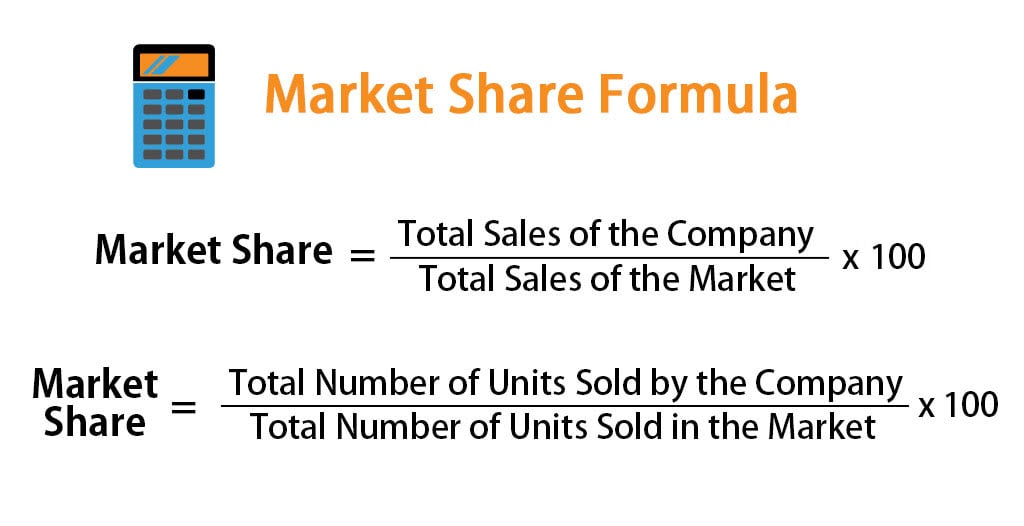

Market Share Formula Calculator Examples With Excel Template

Pin On Www Farmasius Com Donovanthtirado

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

The Chant Of Light By Marion Montgomery

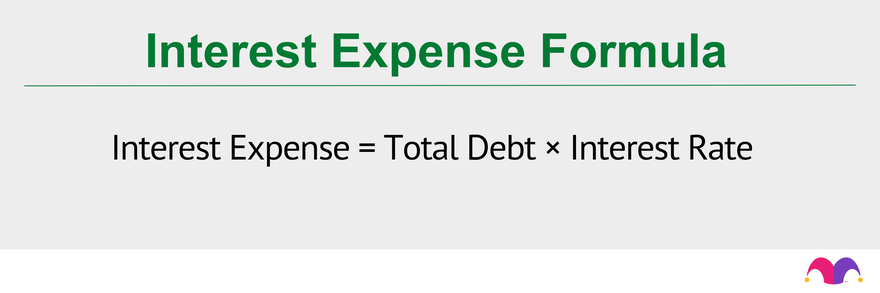

Interest Expense Formula How To Calculate

Net Asset Formula Examples With Excel Template And Calculator

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)